A practical guide to surviving uni life in Sarawak on a budget. And how Swinburne Sarawak’s finance degree turns money smarts into opportunity.

It’s Week 8 of the semester, and your wallet feels suspiciously lighter than your backpack. You check your account balance and… where did all your money go? Welcome to the reality of student budgeting in Sarawak.

Student Budgeting Without the Lecture

If this sounds familiar, welcome to the broke-but-thriving student club. Between laksa brunches, “just one” bubble tea runs, and those late-night mamak sessions that magically become a RM50 expenses, being a student isn’t cheap.

But relax. This is not one of those “stop having fun and eat Maggi for a month” lectures.

This is about learning how to stretch your ringgit without killing your social life (or your love for kolo mee).

Why Student Budgeting Even Matters

Admittedly, budgeting sounds about as exciting as studying for your upcoming exams. But hear me out because knowing where your money goes means:

- Enough money saved for that Satang island snorkeling trip everyone’s planning

- Money for that One OK Rock concert next April next year

- The freedom to treat yourself to bubble tea without guilt

- And no more plain rice dinners at the end of the month.

And the best part? You’ll actually sleep better knowing you’re not one tap away from financial disaster. (Plus, if you get really good at this, tehre’s always a finance degree waiting for you at Swinburne.)

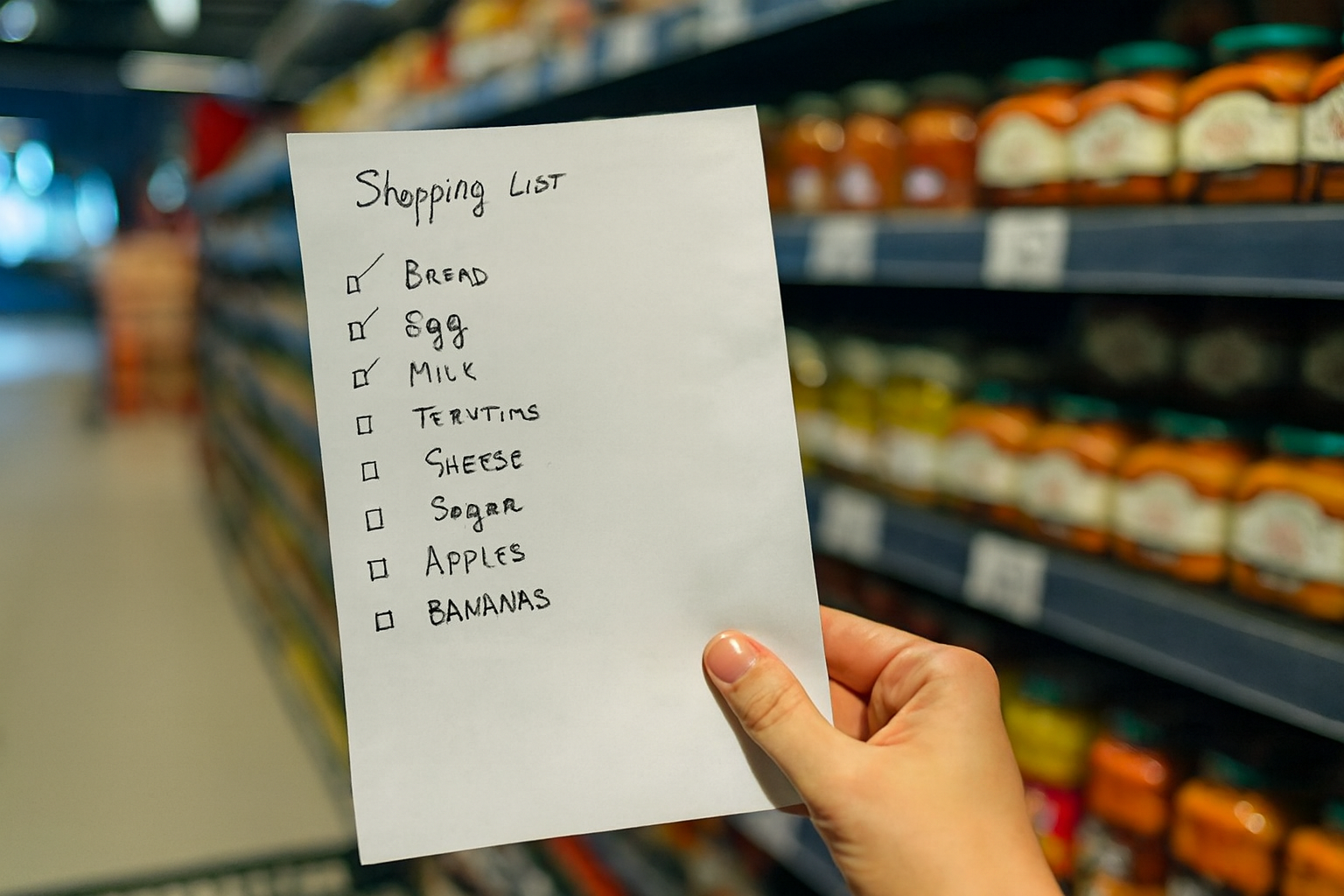

How to Create a Realistic Student Budget

Forget Excel formulas that make your brain hurt. Here’s a realistic money management breakdown for Kuching life.

A sample budget for living and studying in Kuching:

- Food: RM300 (RM200 eating out + RM100 groceries from Everrise Supermarket)

- Transport: RM150 (Grab, petrol, or parking)

- Phone/Internet: RM60 (your prepaid or postpaid plan)

- Fun Money: RM250 (movies, hangouts, impulsive shopping)

- Emergency Stash: RM150 (because… life.)

Tweak it however you need. Staying in near a commercial area? Food’s cheaper. Renting? Add utilities. No judgment if your ‘fun’ budget is mostly snacks. This is about balance, not sacrifice.

Apps That Make Student Budgeting Easy

You don’t need to be a finance nerd. These apps are simple, free, and actually kind of fun:

- Your eWallet Apps – SPay, Boost, and GrabPay. These already track spending. You just have to… look

- Spendee, Money Lover – Simple, visual apps that track your spending in RM so you actually see where your money goes. Useful even for the free version

- Google Sheets – For control freaks (respectfully). Simple, customizable, and cloud-synced.

Simply pick one and commit for a week. That’s it. Student budgeting does not have to be complicated.

Sarawak Life Hacks for Smarter Spending

- Food: pack lunch twice a week and you’ll save RM100+ a month. That’s two bubble teas every day or one fancy dinner at Topspot

- Transport: use ehailing service only when it makes sense. Because RM8 saved per trip adds up fast

- Student Discounts: flash your student ID everywhere. Many cafes, bookstores, and even clothing stores around Kuching offer 10–15% off. Don’t be shy to ask

- Kopitiam > Café: RM15 latte? Or RM2.50 kopi that actually wakes you up? The math speaks for itself. Save the café vibes for special days or study grinds.

The “Don’t Be a Hero” Rule

It’s okay to say, “I’m on a budget this month.” If your friends are cool, they’ll get it. Suggest cheaper hangouts like potluck dinners, hiking trips, movie nights in.

And if you’re consistently broke before the month ends, that’s a red flag. Just remember that that’s not a personality trait. So, adjust your habits. And if things get rough, talk to your family. They’d rather help than see you struggle in silence.

Your One-Week Challenge

Track every single thing you buy for one week. Not a month. Not a year. Just seven days. You’ll be shocked. Surprisingly, most students spend RM20 -RM30 daily on random stuff they barely remember buying. That’s RM600 to RM900 gone every month.

Use an app, a notebook, your Notes app – basically, anything. No judgment, just awareness.

The Bottom Line

Budgeting is not about being stingy. It’s about being smart. It’s choosing what actually matters to you. Want to save up for that new phone? Great. Prefer spending on experiences with friends? Even better. Want both Sarawak laksa and bubble tea? Respect.

Obviously, you’ll still go broke sometimes. It’s part of the student experience. But at least now you’ll be strategically broke. And honestly, that’s kind of a flex.

Turn Student Budgeting into a Career

If this whole budgeting smart thing has you thinking, “Wait, maybe I’m actually good at this money stuff,” then it might be time to turn that skill into something bigger.

At Swinburne Sarawak, the Bachelor of Business (Finance) and Bachelor of Business (Accounting and Finance) programs, among others, take you beyond budgeting apps and spending trackers. This finance degree prepared you for real-world financial careers. You’ll dive into financial planning, investments, and business strategy – basically, how money really moves in the world.

So if managing your money has secretly become your superpower, maybe this is your sign to make it official. Because you’re already managing your wallet like a pro, why not build a career that does the same on a bigger scale?