Flip open a newspaper these days and it is becoming commonplace to see an article reporting on yet another scam victim. Despite scam incidents becoming so common, for most of us it feels so near yet so far. We fear becoming the next victim, but ironically when we read these articles, we think that the red flags are so obvious that a scam would be the last thing to befall upon us.

We should, however, remember that scams are in fact a psychological play on our emotions, whether positive or negative, to elicit the outcome the scammer wants.

UNVEILING SCAM TACTICS

As our lives become increasingly intertwined with the internet, this wave of scam incidents we are seeing will show no signs of slowing down. By empowering ourselves with an understanding of common scam setups, we will be able to identify the key characteristics of scam schemes.

Some of the recent types of commonly-used scam tactics.

We break down some of the recent common scam tactics below:

- Phone scams:

These range from bank or tax fraud calls threatening a police investigation, fake charity calls, prize scams, and fake calls from seemingly trusted people or organisations. Common characteristics of such phone scams are the pressure to send or give money and the request for personal information including personal and/or banking credentials.

- Fraudulent mobile phone apps for service providers:

Currently prevalent among online booking services, the user is required to download an app to secure a reservation for a seemingly legitimate service. The fraudulent app is in fact a malware designed to steal personal credentials, read one-time password (OTP) SMS and send messages.

- Romance scams:

With our lives and preferences so widely shared on the internet, romance scams have turned into a highly orchestrated affair. Carried out across a period of time, victims are targeted with “love and care” from the scammer, and later convinced into giving money to their “loved one” to make an investment or to assist them through a “dire” situation.

- Investment scams:

Often tied with romance scams, an enticing investment proposal is offered with actual earnings in the early stage, which convinces additional investment that later becomes impossible to cash out.

- Impersonation scams:

These include fake shopping sites, fake emails and fake messages with links or prompts to take action on a fake website designed to mine personal and banking credentials.

PURPORTED SCAMS OVER A PHONE CALL

Some victims report being scammed during a phone call. This then raises the question if it is possible to lose our money from simply picking up a scam call. According to Dr Colin Tan, a lecturer with the Faculty of Engineering, Computing and Science, it is not possible unless a malicious app was already installed on the phone prior to the call to steal information and monitor phone activity. Personal information has to be provided in order for a scam to take place, and this applies to the content of the call conversation as well.

WHAT CAN WE DO?

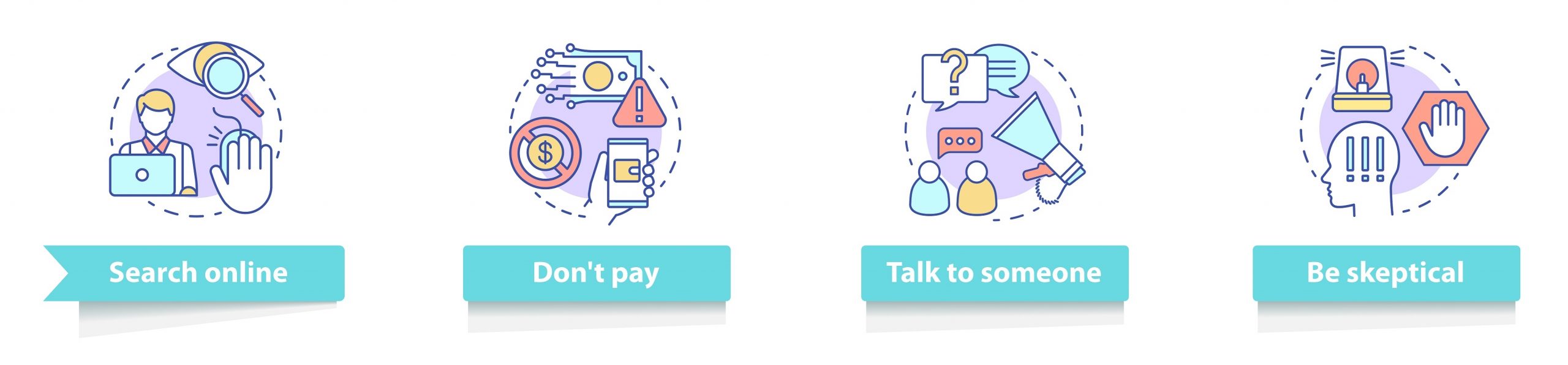

Quick tips to remember by to protect ourselves against scammers.

Although scammers are constantly pulling new tricks out of their hat in response to public awareness towards their tactics, there are a few hard and fast rules we can follow to protect ourselves:

- Never divulge personal and banking credentials, nor OTP numbers over the phone or through messages.

- Any pressure to give or provide money right away is a tell-tale sign of a scam.

- If the deal seems too good to be true, it probably is.

- Never respond to strangers soliciting contact or offering lucrative investment opportunities online.

- Always ensure that all mobile apps downloaded onto the phone originate from the phone’s app distribution platform.

- Ignore robocalls and suspicious incoming calls. If you find yourself in the midst of one, hang up immediately.

- Whenever in doubt about a call or message from a trusted friend or organisation, personally verify its legitimacy before taking action.

Reduce your rate of risks further with this tip from Dr Colin: Avoid depositing large sums of liquid cash in your bank account and instead, move it somewhere else where instant withdrawal or transaction is not possible.

The opinions expressed in this article are the author’s own and do not reflect the view of Swinburne University of Technology Sarawak Campus.